flow through entity private equity

The basic financials of X are as follows. Also known as a flow-through entity or a pass-thru entity this type of business structure allows profits to go directly to the owners or members who pay individual income taxes on any revenue.

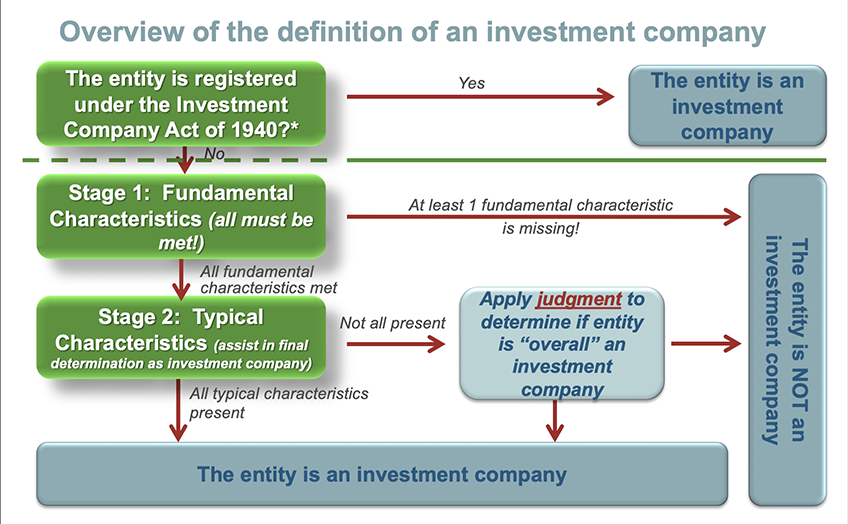

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

Company X is owned by two businessmen in Los Angeles.

. Or other flow-through entity is attributable to the flow-through entitys interest direct or indirect in the. With flow-through entities such as S corporations and. Flow-through portfolio company as the court decision may permit the non-US.

A pass-through entity is a business structure in which the taxes on the generated business revenue are directly passed on to the owners to avoid double taxation. Most governmental plans take the position that as governmental entities. Corporation a so-called Blocker which insulates such investors from the direct obligation to pay US.

The team of individuals that will identify execute and manage investments in privately-held operating businesses. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. A purchaser will still obtain a basis step-up in the context of the purchase of 100 of the entity equity interests.

A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible economics a control vehicle and the ability to grant profits interests as a compensation incentive discussed below. The reason for passing through income structure is that the owners otherwise get double taxed Double Taxed. Tax exempts and non-US.

In this legal entity income flows through to the owners of the entity or investors as the case may be. Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business and compare whether a flow-through partnership or S corporation S corp structure is still the right approach to meeting your business goals. Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US.

We dont know how the new tables are going to look but based on the current tables a 25 rate would be favorable at single income of 91901 and married joint of 153101 but it really doesnt. 2 LPs and LLCs are pass-through entities for federal income tax purposes. Since it is a flow-through entity the owners must report their earnings as income when filing pers.

Blocker to exit its investment in the US. Through this arrangement business owners and shareholders only pay taxes on their personal income generated through this business and dont have to pay additional corporate taxes for running. 1 Financial Sponsor Sponsor in image.

PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels. Although minimum investments vary for each fund the structure of private equity funds historically follows a similar framework that includes classes of fund partners management fees investment. The baseline structure would involve the private equity buyer acquiring both the flow-through and blocked portions of the investments under a single aggregating vehicle taxed as a partnership for.

With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals. Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below.

The entity passes its total income to the entitys owners and therefore taxes are calculated on the individual basis on each and every owner. In 48 states pass-through entities account. Hence the income of the entity is the same at the income of the owners or investors.

Tax exempts and non-US. These businesses effectively avoid double taxation or taxing both corporate income and individual income. An entity taxed as a flow-through will generally have greater value because of the significant tax benefits and that can be afforded the purchaser than for.

Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a US. Raising a private equity fund requires two groups of people. It is typical in private equity funds for certain tax-sensitive investors including US.

Private equity firms are on a buying spree as they seek to accelerate portfolio company growth amid a relatively slow-growing economy. Some of the most active investors in private equity funds are governmental pension plans such as those for states or municipalities. In an earlier article titled Rollover Equity Transactions 2019 we discussed the various business and tax issues associated with transactions involving private equity PE buyers who include rollovers of target owner equity in their leveraged buyout LBO transactionsHere we take a deeper dive into the ramifications of having some PE investors invest in target.

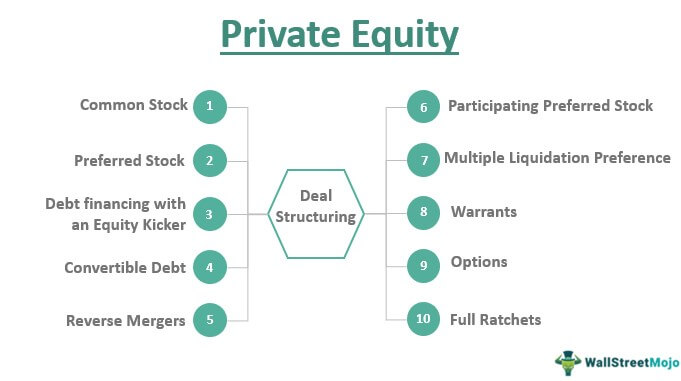

Venture capital funds and private equity funds typically contain significant limitations on the ability of investors to transfer their partnership interests. It is typical in private equity funds for certain tax-sensitive investors including US. Planning devices can include the following.

Blocker corporation to hold an investment in a US. The pass-through entity can be defined as a process by which any organization will be relieved from double taxation burden. Blocker corporation rather than a US.

Real Estate Capital Markets REITs. This is generally comprised of a General. Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a US.

Corporation a so-called Blocker which insulates such investors from the direct obligation to pay US. One reason for such restrictions is a funds need to avoid.

Cash Sweep Helps You Pay Debt Or Earn Higher Interest Cash Sweep Accounting And Finance Accounting

This Infographic Details Entrepreneurship Statistics In The Uk Entrepreneurship Economic Development Private Sector

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Investing Budgeting

A Beginner S Guide To Pass Through Entities The Blueprint

Current Yield Meaning Importance Formula And More Finance Investing Accounting Basics Learn Accounting

Singapore Company Incorporation Singapore Company Starting A Business

Pass Through Entity Definition Examples Advantages Disadvantages

Joint Venture Joint Venture Financial Management Financial Strategies

A Limited Liability Company Can Be Formed Of Minimum 2 To 50 Person Whose Liability Is Limited To Their Shares In Th Limited Liability Company Llc Business Llc

Private Equity Fund Structure A Simple Model

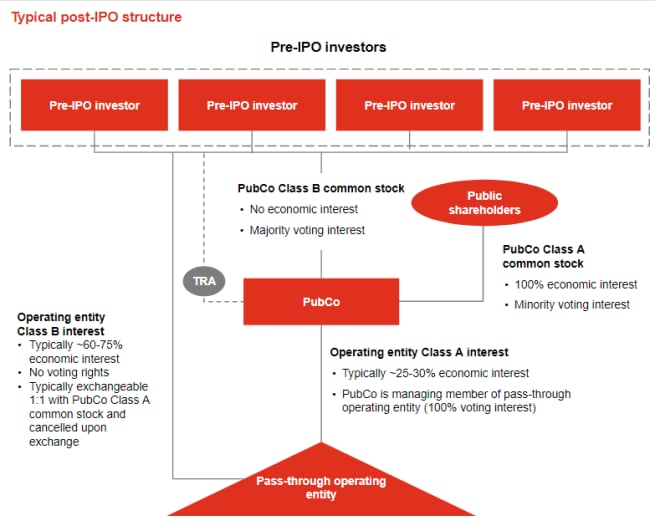

Umbrella Partnership C Corporation Up C Structure Pwc

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Private Equity Meaning Investments Structure Explanation

Pin On Journal Spreads And Notes

A Limited Liability Company Can Be Formed Of Minimum 2 To 50 Person Whose Liability Is Limited To Their Shares In Th Limited Liability Company Llc Business Llc

Pass Through Entity Definition Examples Advantages Disadvantages

Pin On Doing Business In Singapore

One Person Company India Vakilsearch Sole Proprietorship Public Limited Company Company

Converting Sole Proprietorship To Sg Pte Ltd Company Registration Guide Sole Proprietorship Private Limited Company Small Business Management